According to the Bank of International Settlements, the US Dollar was part of as many as 84.9% of Forex trades. At the same time, yields in the United States were some of the lowest in the world. This article will attempt to explain why.

As we often see in the carry trade, investors acting rationally in normal market environments will follow yield. Meaning, if all factors are equal and you are given a choice between an investment paying one percent and an investment paying five percent – most rational people will choose the five percent option.

This article will examine the what’s and why’s of the times when you might want to pick the one percent investment instead.

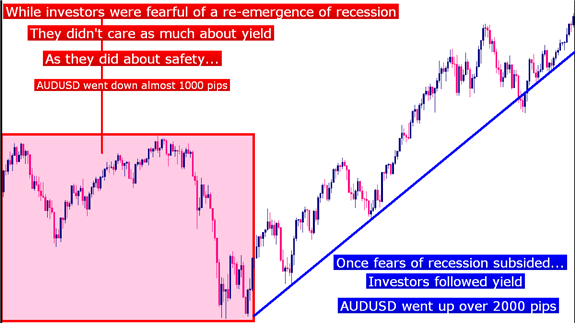

One look at the AUDUSD chart from 2010, which saw lows of .8000 move up to 1.1000, the entire period of which positive rollover was being accrued for holding long positions in the pair, will confirm the fact that, typically, investors will follow yield.

Created with Marketscope/Trading Station

But what happens when the market environment isn’t normal?

Such as the 2008 Financial Collapse... or the Tech bust… or the S&L crisis?

These are just three of the bigger and more recent examples, but you probably see where this is going: While a five percent investment will often be more attractive than the one percent investment – once the question of losing your investment altogether comes into play, the ‘safety’ of each option becomes all the more important.

As a matter of fact, if you look at the above chart you’ll notice it wasn’t all roses and daylight for ‘The Aussie’ in 2010. I’ll post the chart below from a different angle than we had looked at previously:

Created with Marketscope/Trading Station

Relative Safety

While the thought of an entire economy such as Europe, or Australia going bankrupt may seem ludicrous, we have to realize that investors, in all of their fashions whether they are hedge fund traders or central bankers – all hate to lose money.

And through the tests of time, the United States Treasury Bill has proved to be one of the safest financial instruments the world has ever seen.

No comments:

Post a Comment